It took a while but I managed to get an account. You have to be patient at times because the servers are maxed out. ChatGPT and its sister product DALL-E 2 is amazing and scary at the same time. As in any new technology, comments range from acclamation to criticism. Where do we go from here? Love it or hate it, the genie is out of the bottle. The beast is out. There’s no turning back. We have to adapt and learn how to live with it.

Quick primer. What is ChatGPT & DALL-E 2? They are text-to-image generators that let you type in almost any phrase and get an image or some kind of smart answer. Go check it out. I can spend 5 minutes writing what it’s about, or you can go try it yourself. The “wow” factor is in playing with it, not reading what it is, just like it’s more fun to drive a car than looking at a picture of it. This thing is an assistant, a doctor, a lawyer, a coach, a co-chef, an artist, and an advisor of all sorts. It’s not perfect and it make mistakes, but I’m not perfect either.

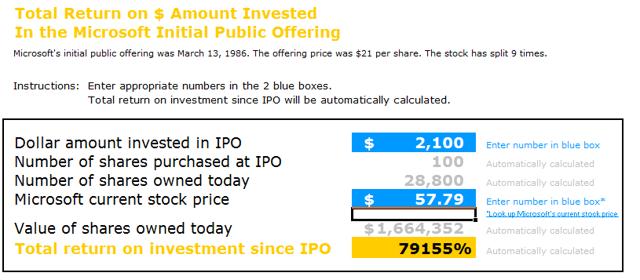

Both products are creations of OpenAI (wiki). OpenAI is now a for-profit organization. It started as a non-profit in 2015. It was funded by Elon Musk, Peter Thiel, Sam Altman and others. The business is currently run by Altman. Musk resigned from his board seat in 2018. OpenAI is now backed by Microsoft. The partnership with Microsoft allowed them access to the computing resources it needed to train and improve its artificial intelligence algorithms. Microsoft now wants to incorporate the OpenAI tools in its products. More on this later.

For decades, we’ve been hearing about how AI is going to change how we interact with the world. We see AI in action, mostly in the background, when we use Netflix, our email, when we shop on Amazon. But I think this is the first time we actually use it to create something. It’s the first time most of us recognize it in action. Almost every time I put in a prompt and see what’s returned I’m amazed, entertained and scared, all three combined.

It had that “feel.” The first time I used the Internet. I knew. I just knew that it was a game changer. Not exactly how, but I knew that it wasn’t just a trend. There was no going back. It’s hilarious to write this, but at the time many experts didn’t think the Internet would live last, or work. I’m serious. Look it up. Or what about when the iPhone came out. You knew it was a game changer.

First thoughts on ChatGPT: “Wow this is crazy amazing, and…..Is anybody ever going to do work anymore? Who wants to write papers?”

The technology is fun but full of potential unknowns. And there’s this whole question of ethics (I’ve seen called an “ethical fiasco”). I grew up watching Terminator. My brain wasn’t shaped into thinking about a rosy future about AI robots. What if down the lane the robot overrides its programming and becomes independent? It’s not helping that I’m watching Westworld. In a sense, you can argue that the machines have already won and they didn’t have to fire a shot. We are on our cell phones all the time.

Back to ChatGPT/DALL-E. New game changing technology creates opportunities and lots of incertitude. There’s no going back. What does it mean for your job? If you are an artist, this is a nightmare. I mean the thing is cranking out poems. If you are not an artist, like me, this is awesome because I don’t have to learn how to use the Adobe slate of products. If you are a copyright lawyer, this is a goldmine. But I’m also worried about what it means for my career in the future. I’ve seen ChatGPT being used for legal advice and it’s not bad.

The current version of ChatGPT is 3.5. It’s embryonic right now (beta). ChatGPT is more than a flash in the pan. We are in the first inning. It will need to scale. But as it develops, as it races to build it so that it could fully mirror the intelligence and capabilities of humans, who knows what we are getting into.

ChatGPT 4.0 will come out this spring and I heard it will be a massive improvement. And you know this will have 5.0, 6.0….10.0….

And you know the competition, like Google, and mainly Google, is not just sitting around doing nothing. A NYT article reported last month that ChatGPT’s launch triggered Google’s management to declare a “code red” internally (so they had a meeting).

Search Engine War 2.0

I remember the search engine war of the 90s-early 00s, when you could choose between Altavista, Yahoo, Excite, Goto, AskJeeves, and many others? Well Google won (duh). Like crushed it. It now has a monopoly on search. Google killed all the search engines. Who’s in 2nd place? Bing? Nobody says “Let me Bing this up.”

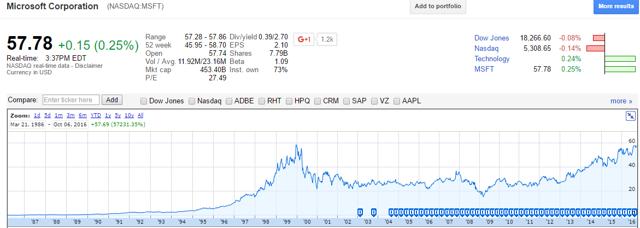

I like Google and its slate of products. It works fine. But maybe it’s time for a little competition. A little shake up, a little pressure, a little there’s something big coming in the rearview mirror called ChatGPT. When you are in 1st place for 20+ years, you can get complacent. It’s just what happens. Google did introduce LaMDA, a rival AI chatbot.

Microsoft, with its Bing search engine, is going all in. Microsoft said it’s expanding access to OpenAI tools. DALL-E 2, ChatGPT, and other AI-powered software will soon become available to Azure OpenAI customers.

It’s early and Google is safe, for now. But as the AI industry takes off, there will likely be a battle between Microsoft and Google. Search engine are a high fixed cost businesses. Once you built the infrastructure, it’s all about scale. Right now, a product like ChatGPT is very computationally intensive. It cost ChatGPT “pennies” per query. Every search is burning cash. It wouldn’t cost or hurt Microsoft much to integrate ChatGPT to Bing because it’s much smaller. But for Google that’s a different story. Search users are very profitable. Deploying ChatGPT like feature (AI tools like Large Language Model (LLM)) is going to be very expensive and eat in their margins, and that’s just to keep market share. And I’m not sure ad revenue would be more profitable (less if you lose market share).

So, at the moment, the economics of deploying LLM isn’t quite there yet. It’s one thing to demo it. It’s another to try to integrate it deeply in a system with billions of request a day. Think of the cost and the latency. Those are two major bottlenecks I read that cost would need to go down at least 10x, or more, before it starts making sense. It will take some time.

Don’t fight the tide, swim with it

AI is a massive wave. Don’t fight the tide. Swim with it. Jobs and lives will be disrupted. Nothing is static forever. You need to adapt. As for artists, maybe it is a chance to use and adopt new tools. Just like they did with the PC, photoshop, and the Internet. Any new technology can be seen as a threat at first. The PC didn’t kill the artist. It probably made the artist better. Lawyers will be better. Doctors will be better.

Fighting this won’t help. You have to embrace it. Remember when MP3s came out? It did kill the CD industry. But it didn’t kill music. MP3s disrupted music. Some artists were fighting it. In the end who won? The companies that adopted MP3s (Apple/iTunes), artists and the consumers. More music is being created than ever. More music is being consumed than ever.

ChatGPT is a deflationary force in an inflationary economy. What it means for productivity, competitiveness, efficiency is incalculable. Every organization in every industry will need to infuse this sort of AI technology in every business process and function so they can do more with less. It’s what I believe will make the difference between organizations that adopt changes and those that get left behind. There is an opportunity to apply technology to make a real difference has never been greater. You get to leapfrog. Imagine if you have nothing in the middle of nowhere, but you have access to this tool, it’s powerful. It will empower the people at the bottom. It will allow them to achieve more.

I’m not saying I like it. I’m not pro or anti AI. It’s just is. Just like I don’t hate or love steel. I do my have concerns. There’s a lot of incertitude. But that’s mostly because we don’t understand it. There are already books published by ChatGPT. I’m not sure what to make out of that. You don’t have to buy it. You don’t have to read it.

Or maybe this won’t age well, like the Newsweek article above. I’m just trying to be optimistic.