*Brookfield Asset Management’s Class A Limited Voting Shares are co-listed on the NYSE under the symbol (BAM) the Toronto Stock Exchange under the symbol (BAM.A)and Euronext under the symbol (BAMA.) I will be referring to the American symbol for the article. Dollar amounts are in USD$ unless mentioned otherwise. BAM currently trades for ~$40 with a market cap of $40 billion. It’s currently trading down from its all-time high of ~$44.

I had the privilege to be a guest on The Intelligent Investing Podcast with Eric Schleien. We mainly talked about Brookfield Asset Management but we barely scratched the surface. Since I wanted to elaborate on some points, I wrote this primer on Brookfield as a companion guide to the podcast. I have no affiliation with The Intelligent Investing podcast whatsoever, but I am a fan of his work.

Brookfield Asset Management (BAM, BAM.A) is one of the most under-rated, under the radar, low profile company in the world. Brookfield doesn’t make headlines. For those of you that are in the investment business, you are most likely familiar with the global value investor Brookfield, its CEO Bruce Flatt, and the tremendous success the company had under his leadership. For the folks that are not in the investment industry, you wouldn’t know that Brookfield owns a large chunk of the arteries and pipelines essential to how global economy functions. BAM owns some of most prized real estate in the world, such as Manhattan’s prestigious World Financial Center. In Berlin, it owns Potsdamer Platz and, in London, Canary Wharf. And that’s just the real estate. In Ireland it supplies Facebook with electricity. A good part of Chicago is powered by Brookfield. It owns 36 ports in the UK, North America, Australia and Europe, and in India and South America it manages 3,600 kilometres of toll roads.

Brookfield Place “World Financial Center”. Source: therealdeal.com

Brookfield Place “World Financial Center”. Source: therealdeal.com

Brookfield is a global alternative asset manager with $285 billion in assets. They employ a value investing style, where they shop around the world for bargains, with a penchant for distressed assets. BAM has the distinction of being an owner-operator of their assets. BAM’s modus operandi is to buy the asset on the cheap, fix it, improve the cash flow and value of the assets, sell it at maturity, and efficiently redeploy capital back into new development opportunities. A quick Google search of Brookfield Asset Management would freak out most investors. Among the results, you will links to Jared Kushner’s infamous 666 Fifth Ave. deal, mall operator General Growth Properties (GGP),Brazil, and Canada’s controversial Trans Mountain pipeline; basically deals that contribute to lack of sleep. But isn’t it odd that Brookfield finds opportunities that everyone else deems as uneconomic? All these moves have an anti-herd contrarian mentality. If there’s a dearth of capital, expect Brookfield to be sniffing around. A crisis is a good time to find value. It seems to have worked out well for the company. Brookfield’s formula for making contrarian investments by going where capital is most needed and in the shortest supply has worked well for Flatt in his 16 years as CEO.

Chart: Yahoo! Finance.

Chart: Yahoo! Finance.

Under Flatt’s leadership, from February 1, 2002, to May 1 2018, BAM returned 1110%, or 11x your money, compared to 1.4x for the S&P 500. This doesn’t include dividends.

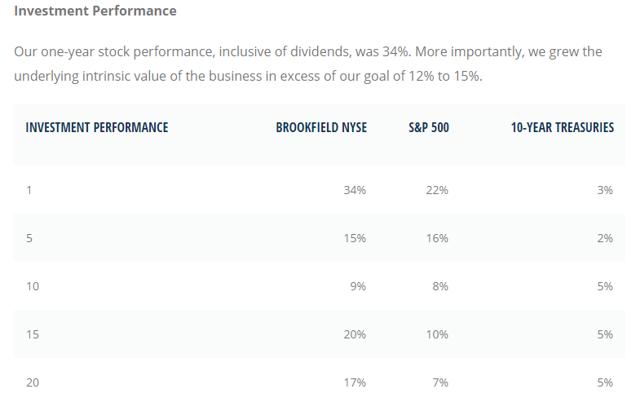

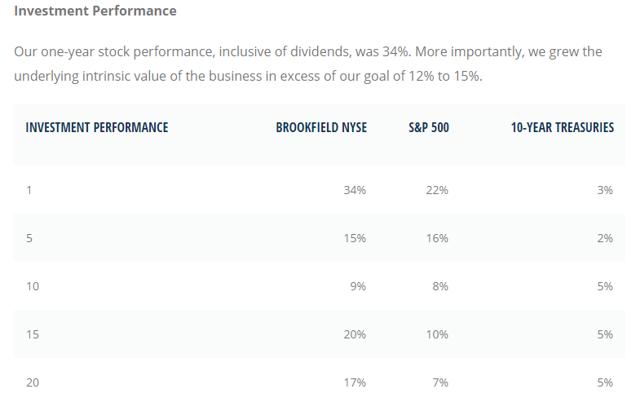

BAM, known for its low profile, is not afraid to display their great performance in their latest annual report (pdf). BAM mentions that they target returns of 12% to 15%. These numbers under estimate their real returns. The figures below include dividends:

Source: BAM 2017 Annual Report. Page 8.

Source: BAM 2017 Annual Report. Page 8.

BAM is a global alternative asset manager. What are alternatives assets? Well traditional assets are stocks and bonds (equity and debt). Alternative assets can be real estate, infrastructure (ports, pipelines, toll roads etc…), renewable energy and private equity among other things. Alternative assets are a little bit of a misnomer because all assets are composed of equity and debt.

Brookfield loves “real” assets. The emphasis is on “real” because we currently live in a world where investors highly value intangible assets. Some of the top companies by market capitalization barely have any tangible assets. For example, Facebook (FB) and Alphabet (GOOGL) are highly valued for their intangibles/intellectual properties, and sometimes that can be hard to value (e.g. network effects). Brookfield is the exact opposite; they love these tangible hard assets with a nice cash stable cash flow that can grow in value over time.

Brookfield likes to focus on long-life, high quality real assets. “Long-life” because BAM invests in assets like a hydroelectric dam that can last over a hundred years. “High-quality” because these assets are considered critical to the economy, scarce, and have a high barrier to entry. They also come with a 15 to 20 years contract with clauses for yearly price escalation and inflation. For example, one of BAM’s publicly listed partnerships, Brookfield Renewable Partners (BEP), sells the majority of its power under long-term, inflation-linked contracts that allow them to capture increases in power prices over time. This provides stable cash flows for a very long period.

Who also likes the investment profile of “alternative assets”? Pension funds, institutions, insurance companies, university endowment funds, sovereign wealth funds among others. Over the last twenty years, there has been an increase to their portfolio allocation to alternatives, and the shift seems to gather pace. Why is that? Pension funds have long-term obligations and in a world of low interest rates, they seek return outside the stock market with less volatility.

Institutions’ thirst for alternative assets provides Brookfield with the type of capital they need, which is a lot and patient. BAM is typically one of the largest investors in their funds. This provides an alignment of interest with their investors. Below is a list of BAM’s publicly listed partnerships (L.Ps) and their equity ownership interest. BAM also manages over 40 private funds.

Brookfield Property Partners (BPY) – 64% – Operations include the ownership, operation and development of core office, core retail, opportunistic and other properties. BPY consists of 147 properties totaling 100 million square feet of office space. BPY also has a portfolio of regional and urban malls (mostly GGP). Brookfield Renewable Partners (BEP) – 60% (*Wrote about here). – Operations include the ownership, operation and development of hydroelectric, wind, solar, storage and other power generating facilities. BEP consists of 217hydroelectric stations, 76 wind facilities, 537 solar facilities and storage.Brookfield Infrastructure Partners (BIP) – 30% – Operations include the ownership, operation and development of utilities, transport, energy, communications and sustainable resource assets. BIP’s main assets are ~2,000 km of natural gas pipelines, ~12,000 km of transmission lines, and ~3,500 km of greenfield electricity transmission developments, ~10,300 km of railroad tracks, 4,000 km of toll roads, 37 port terminals, and BIP also owns ~15,000 km of natural gas transmission pipelines, primarily in the U.S., and 600 billion cubic feet of natural gas storage in the U.S. and Canada. Brookfield Business Partners (BBU) – 68% – Operations include a broad range of industries, and are mostly focused on construction, other business services, energy, and industrial operations.

Long before Brookfield was an asset manager, BAM invested its own capital to develop, own, and operate assets. It’s in the early 2000s that BAM began other private investors to partner with them. As an owner-operator, BAM works to increase the value of the assets within their operating businesses and the cash flows they produce. They do this through their operating expertise, development capabilities and effective financing. This is significant because if it’s done properly, this is how Brookfield achieves superior returns. BAM has over delivered on their target of 12% to 15%. Once the asset has achieved targeted returns and cash flow has “matured”, BAM sells the asset to a buyer looking to achieve a yield of 5% to 7%. Most institutions are fine with that kind of return since the asset has been “fixed” and “de-risked”. Below in the article I provide a real example on how BAM operates.

Brookfield Place “World Financial Center”. Source: therealdeal.com

Brookfield Place “World Financial Center”. Source: therealdeal.com