We live in strange times. I don’t know if this is just me, but right now with everything that’s going, and all the changes, I can’t differentiate what is a fad or a revolution.

Category: Humor

When Harvard Interviews Seinfeld

I came across this gem on Twitter. The image below is a snapshot of an interview Harvard Business Review conducted with Jerry Seinfeld in 2017. Two question in and the interviewer brings up the consulting firm McKinsey, well because it’s Harvard. Anyway I though the following exchange was very funny.

There’s a lesson here. The quality of the answers is positively correlated to the quality of the questions. Ask dumb question, get a dumb answer (or a funny in this case).

You can read the full original interview here: Life’s Work: An Interview with Jerry Seinfeld by Daniel McGinn

A Little Corona Humor

Gaps In Various “Scientific” Virus Models

Just as in investing and climate change, accurate models are difficult. It requires a lot of assumptions and judgment. Even if you are off a degree here and there, it can have a massive impact on the results. You need to understand its limitations. That’s why a margin of safety (error) is important.

My God…those meetings really could all have been emails

Being A Risk Manager Isn’t Easy

New Toilet

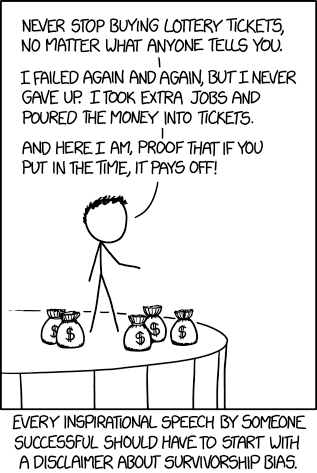

Survivorship Bias

If Consultants Ran Christmas

Repost from The Economist

An elf-and-safety nightmare

Thanks for asking us to have a look at your business model. Our staff have now recovered from their frostbite and have a number of significant suggestions for a revamp before next year.

First, the brand name. The business seems to use several different monikers, including St Nicholas, Santa Claus and Father Christmas. We suggest settling on one of the three. Father Christmas is clearly paternalistic and gender-biased. St Nicholas is too overtly religious. Santa Claus is a much more inclusive term. Once trademarked, there is a ton of money to be made from merchandising rights, particularly from greeting-card companies and department stores. Frankly, your intellectual property is an underutilised resource.

Making better use of it could help address your most glaring challenge: the lack of any revenue stream. Mince pies, carrots and glasses of brandy are not a sound basis of remuneration for a multinational organisation. And who pays for the raw materials needed to make the presents? Given the lack of paperwork about your funding, we are surprised that the authorities have not launched an investigation into money-laundering.

Next, the distribution system. We admit you have an excellent record to date. However, in attempting to deliver millions of presents from a single point over the course of one night, you have been flying by the seat of your sled. It would take just one injured reindeer or a chimney accident and the whole system would grind to a halt. It is far from clear how you co-ordinate your flights with air-traffic-control systems.

Outsourcing is the obvious answer. Amazon, Fed Ex and ups would do the job just as efficiently. If the chimney-delivery route is still preferred, then small drones may be the answer.

Now let us turn to working conditions. Basing your operation at the North Pole exposes your workers both to extreme cold and, thanks to climate change, melting ice. It is a health-and-safety (or should that be elf-and-safety) nightmare. Speaking of which, our human-resources department is unsure whether employing elves should be classed as an admirable diversity policy or discrimination against Homo sapiens. As with distribution, the operation could be outsourced. The elves could be retrained, perhaps as shoemakers.

Our team was also very concerned about animal welfare. Asking reindeer to fly around the world in one night, pulling a heavy load, must put an enormous strain on their physiques. One of the reindeer has a very shiny nose and we recommend immediate veterinary attention.

The next issue is data protection. You tell us you have a “list” which records whether children are “naughty or nice”. We are afraid that checking it twice is simply not an adequate safeguard. Children, and their parents, have the right to inspect the list to see whether they agree with your assessment. Even keeping the list is a breach of data-protection rules around the planet. And how are the data compiled? The fact that you see children when they are sleeping, and know when they are awake, suggests surveillance on an Orwellian scale. This must be stopped immediately. If you insist on pre-gift monitoring, simply look at the children’s Snapchat accounts. That should tell you all you need to know.

While we are on the subject, how do you know which families celebrate Christmas and which do not? In some jurisdictions, you may be liable to a religious-discrimination lawsuit.

We are also worried about succession planning. No insult intended but the white beard suggests you are past retirement age and your rotund physique does not bode well for your health. You need to hire a graduate, preferably from an Ivy League college such as Yule University.

The good news is that you do live up to many of the precepts of modern business theory. Just-in-time delivery, a flat management structure and a purpose-driven ethos are all things we recommend to other clients. And no one can say that flying reindeer are not “agile”.

Finally, we need to talk about the terms of our bill. Our expenses were considerable; have you seen the price of a first-class seat on Lapland Airways? Your offer of a train set and slippers was very kind, but we prefer a bank transfer. Mind you, if you could drop a hassle-free Brexit solution down the chimney, the people of Britain would be very grateful.

La Bourse de France

Les Gilets Jaunes…