2022

That was one hell of a year. And not in the “it was totally rad” sense of hell. No, actually it was hell in the sense of hell. Or maybe not. My year was actually all right considering everything that is going on. I shouldn’t complain. Pain is relative. My country wasn’t invaded by Russians. I didn’t lose money in FTX. I’m not in an Iranian jail for breaking the dress code. I didn’t die from Covid. Will Smith didn’t slap me on national TV while hosting the Oscar. The FBI didn’t raid my house for classified documents. I didn’t waste $44 billion on Twitter. I didn’t get ban from Twitter. And despite a tough year in the market, my portfolio didn’t lose as much as the market. I remain optimistic. In chaos and disorders, there are opportunities. The attitude and mindset you bring when you approach a problem matters. You can decide to be a victim or not. That’s a choice.

Let’s go back to my 2022 predictions. First, let me say straight up that it’s a fool’s errand to predict anything. I knew that and I know that. But I thought it would be fun to try and see how it held. It’s the time of the year where you get to read about “experts” predictions. I read some stuff, try to stay informed and all of that. But did you ever notice how they never go over their past predictions? But I will go over mine and let’s see how embarrassing it is.

Second, I remember spending maybe 5 minutes making predictions, because I figured it was a total crap shoot.

Third, I had to go back to my 2022 post because I didn’t remember what I predicted.

The first thing that jumped at me was the date of the post. February 22, 2022. Two days before Russia invaded Ukraine. More on that war prediction at the end.

Let’s review,

S&P 500 2022 prediction: Target: 4500

Wrong. Really wrong. The S&P finished at 3832. I was off almost 15%. In hindsight, it was a very stupid prediction knowing that 1) interest rates were going up and 2) the S&P just had a massive 26% return in 2021, and 16% in 2020 based on massive stimulus that was going away. Looks like I wasn’t the only one that’s wrong: The 2022 consensus for the S&P 500 was 4,800 at year end 2022.

Interest Rate 2022 prediction: Interest Rate, 5 rate hikes max. The 10-year T-Bill will finish at 2.5%.

Wrong. 7 rate hikes and the T-bill finished at 3.8%. The Federal fund rate is at 4.25%.

Inflation 2022 prediction: Inflation will come down in the 2nd half.

I’m giving myself a “W” for that one. I nailed the trend. But the inflation number is higher than I expected.

Oil 2022 prediction: The classic safe answer of “between $50 to $100 per barrel”. The narrative is that market dynamics will keep pushing prices higher, well above current levels around ~$93 a barrel. I’m going to go against the grain on this one.

This one makes me laugh. It’s a win that doesn’t feel like a win. The WTI ended the year at $73. Yeah I took the contrarian bet, but the journey! I feel like Apollo in Rocky I. Yes Apollo won, but it didn’t feel like a win. 12 rounds and a beating for the win. Oil hit a peak of $123 a barrel and analysts said that it was only the beginning. And yes energy was the only sector that performed well in 2022, and oil is 50% off its peak and trading at a 52-week low.

Gold 2022 prediction: Gold will finish the year below $2000/oz. Why? The central bank will raise interest rates and “restore” a little bit of trust in the dollar.

Win. Gold finished at $1800/oz. Goldman Sachs called for a $2500/oz by the end of 2022. I crushed Goldman Sachs. I don’t know how to value gold. It was a lucky guess. With everything that’s going on in the world, war, inflation, and the money printing, I don’t know why gold is not higher.

Cathie Wood 2022 prediction: More carnage for ARK

Nailed it. The ARK Innovation ETF was down -69% (-80% at peak). I tried to remember why I made a prediction on Cathie Wood, or why would I even care. I wrote:

As a valuation professional it’s frustrating to watch. People have invested their retirement money and their kids’ education money in her ETFs.

Look I don’t like to see somebody losing money. It can happen to anybody. But there’s a little bit of “I told you so” in ARK’s debacle. We have seen this tape played many times in the past. Her MO is concentrated investments in companies with neat ideas and zero earnings, with astronomic valuations (if they can be measured at all). This is a recipe for disaster because 1) when companies don’t live up to their prospects (e.g. Peloton, Roku…) and 2) when rates rise, and they will, it will hurt the present value of future cash flow. And all of Wood’s investments rely on the future profits in years to come.

At the end of the day valuation matters. Fundamentals matter. Cash flow matters. Profit matters.

I still stand behind that statement.

Russia-Ukraine War 2022 Prediction: Russia won’t do a full invasion of Ukraine. The cost is too high. Instead it will support the separatist regions and will never stop harassing Ukraine through different means (cyberwar, coup, rigged election, propaganda etc…). (Update, a few hours after writing the previous lines Russia sent troops in the breakaway regions of Ukraine. I still don’t think a full invasion will happen.)

Really wrong with brutal timing. And not like I would had I wish Russia invaded just to be right. I still can’t believe Russia invaded. Nobody gave Ukraine a chance. Russia was so confident that the first wave of troops arrived with dress uniforms ready for a victory parade and without nearly enough food. The Ukrainians stood and fought. The Ukrainians have proven themselves.

Record: 4 wins, 3 wrong. It’s not bad. Because I didn’t remember what I predicted, I thought going in that it was would have been a disaster.

As for 2023, I may or may not make predictions. Not because I’m afraid to be wrong. But because I had fun last year making them. It’s impossible to predict the future. But you can plan for it.

We will see.

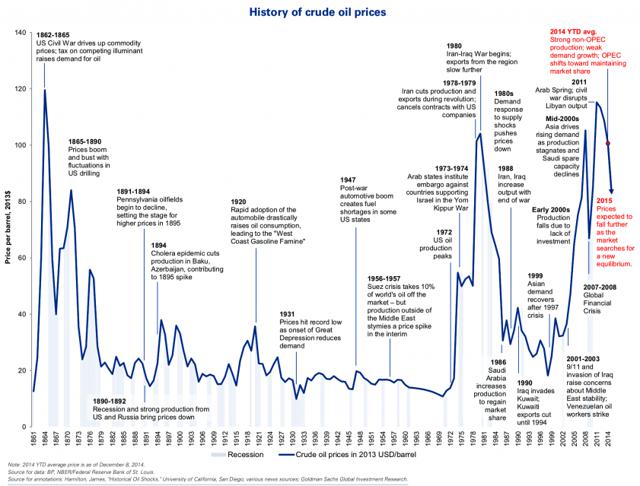

It’s not breaking news that the energy sector has been a disaster zone this year, as the coronavirus pandemic has decimated global oil demand. There’s an assumption that anyone looking to invest in energy stocks, and oil stocks in particular, is an idiot, and that assumption appears pretty reasonable—if you’re looking in the rear-view mirror. There’s might be better days ahead for the industry. But “when” is the key question. There’s an old saying in the oil industry: The cure to low prices is low prices. I expect more carnage in the short-term before it gets better. Companies will be destroyed. There will be survivors that come out on the other side looking stronger. Their shares are pretty attractive right now. But who will survive? Energy is essential. Although demand is down right now, the world is going to need more energy in the future. Low-cost energy will help to boost the global economy.

It’s not breaking news that the energy sector has been a disaster zone this year, as the coronavirus pandemic has decimated global oil demand. There’s an assumption that anyone looking to invest in energy stocks, and oil stocks in particular, is an idiot, and that assumption appears pretty reasonable—if you’re looking in the rear-view mirror. There’s might be better days ahead for the industry. But “when” is the key question. There’s an old saying in the oil industry: The cure to low prices is low prices. I expect more carnage in the short-term before it gets better. Companies will be destroyed. There will be survivors that come out on the other side looking stronger. Their shares are pretty attractive right now. But who will survive? Energy is essential. Although demand is down right now, the world is going to need more energy in the future. Low-cost energy will help to boost the global economy.

Source: Public Domain. A Pennsylvanian oil field in 1862.

Source: Public Domain. A Pennsylvanian oil field in 1862.